- Home

- About Us

- Our Platform

- Product

- Advisory Services

-

Micro Finance

InstitutionOrganization which is registered under

-

Collective Investment

SchemeA Collective Investment Scheme (CIS)

-

ARC Registration

An asset Reconstruction Company

-

Payment Aggregator-

Cross BorderPayment Aggregator - Cross Border

-

Payment gateway

LicenseA service providing entities which plays

-

- Partnership

- News

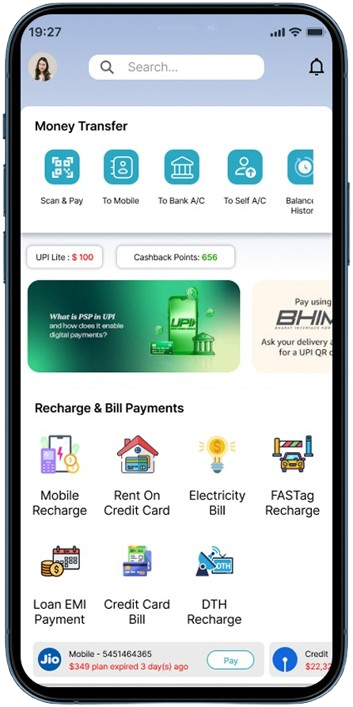

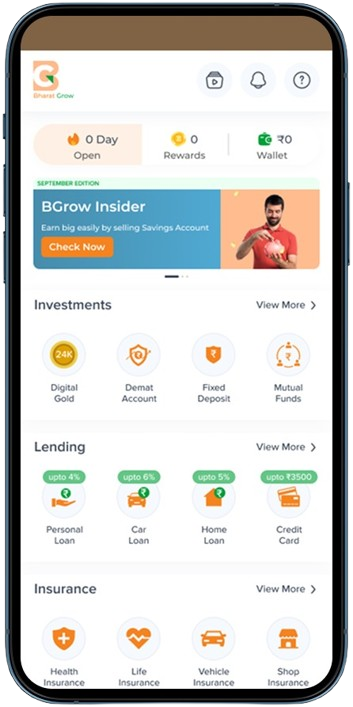

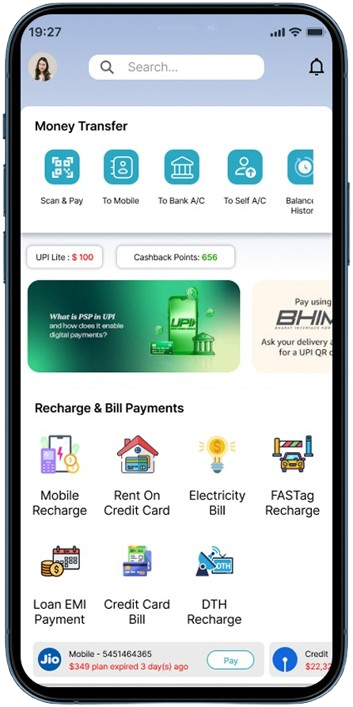

Super App

Bharat Grow empowers you to launch a full-featured Super App — combining payments, banking, shopping, loans, insurance, and more — all under your brand.

The Future of Digital Business Is Super

Consumers want more in one app. With Bharat Grow, businesses like yours can offer a complete digital ecosystem with banking, commerce, finance, and utility services — all in one powerful platform.

Whether you're a bank, fintech, or enterprise, we help you launch and scale your own Super App — fast, secure, and fully customizable.

Key Modules You Can Offer

UPI & Wallet

Recharge & Bill Payments

Travel Booking

Digital Gold & Fixed Deposits

Personal & Gold Loans

Insurance Services

QR Code Payments

E-commerce Marketplace

Mutual Funds & Wealth

Loyalty & Cashback

Platform Capabilities

Built for Scale. Engineered for Flexibility.

🧩

Modular Architecture

Launch fast with ready-to-use modules

⚙️

API-first Platform

Easy integrations with banks, NBFCs, & 3rd parties

🎨

Custom UI/UX

Branded experience tailored to your audience

🔐

Bank-Grade Security

Data encryption, KYC, and compliance tools

📈

Analytics & Insights

Track, optimize, and grow user engagement

🤝

Merchant & Partner Dashboards

End-to-end onboarding and control

Ideal For

🏦

Banks & NBFCs

📲

Fintech Startups

🛍️

Retail Chains & Marketplaces

🏢

Governments & Public Sector Projects

🌍

Digital Ecosystem Enablers

Our Advisory Offerings

Business Strategy

Tailored growth frameworks, market entry strategies, and monetization models to drive scalability and differentiation.

Regulatory & Compliance Consulting

End-to-end guidance on RBI, SEBI, TPAP, PCI DSS, and AML/KYC mandates — ensuring full adherence to regulatory frameworks.

Product Roadmap

Strategic product planning, feature prioritization, and innovation mapping to align technology with business outcomes.

Technology Consulting

Architecture audits, API integrations, DevOps, and full-stack digital transformation — tailored for fintech ecosystems.

Partnerships & Lender Onboarding

Leverage our network of regulated banks, NBFCs, and API infrastructure providers for fast-track integrations.

Licensing & Certifications

Accelerate time to market with assistance in TPAP licensing, PCI DSS compliance, and regulatory interface onboarding.

API Direct Tie-ups

We facilitate direct agreements with leading API providers for payments, credit bureaus, eKYC, and other services.

Investment & Funding Support

Pitch readiness, investor connects, and capital structuring advisory to attract and close early- to mid-stage funding.

PCI-DSS Certification

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to ensure that all businesses accepting, processing, storing or transmitting credit card information maintain a safe environment.

How It Works

From Idea to Super App — In Weeks

Define Your Modules

Choose the services you want: payments, loans, travel, etc.

Customize Your Experience

We tailor the branding, UX, and integrations to your needs.

Launch & Scale

Go live with your own Super App and scale user engagement.

Why Bharat Grow?

Fast Go-to-Market Timelines

Fully Customizable Journeys

Plug-and-Play Integrations

Dedicated Project & Tech Support

Compliance-Ready Infrastructure

Ready to take control of your fintech journey?

Connect with our experts and learn how our Platform aligns with your product needs..